Top Reasons For Selecting Forex Trading Websites

Top Reasons For Selecting Forex Trading Websites

Blog Article

Top 10 Risk Management Strategies For Forex Online Trading

The management of risk is crucial to Forex trading successful. Here are 10 best tips for managing risk that will help you protect your capital and reduce potential losses.

Set Stop-Loss Orders on Every Trade

1. Stop-loss orders for trading automatically end the trade when the price of a market reaches an amount, which limits any losses that could occur. By setting a Stop-Loss, it is possible to can ensure that your losses remain limitless if the market shifts against you. Put a stop loss in place immediately after opening an account.

2. Define Risk per Trade

Limiting the amount you put at risk in one trade should generally not exceed 1 percent of your total balance. You can stay in the market even during losing streaks, and your account will not be wiped out by a single trade.

3. Use Proper Position Sizing

The position size is the amount of currency that you purchase or sell in a specific trade. The position size you choose will depend on the size of your account, the degree of risk involved in the particular trade, and the stop-loss you have set. You should adjust your position in order to keep the same level of risk, such as the stop-loss you set is larger.

4. Avoid Over-Leveraging

A high leverage ratio increases both gains and losses. For beginners, it is best to use low leverage, even though brokers usually provide higher leverage. As high leverage is a risk to wipe out your account when the market is against you, it's better to start small (1:10 or lower) and then gain the experience.

5. Diversify Your Trades

Do not invest all of your capital in a single pair or trade. Diversifying your trading by using different timeframes or pairs will decrease the possibility that you'll lose money due to unanticipated events. To ensure that you don't lose focus by diversifying too much, it could cause you to lose focus and divert your focus.

6. Implement an Investment Plan with Risk Limits

A trading plan with clearly defined rules regarding entry departure, exit and risk tolerance can assist you in keeping your sanity. Set weekly or daily limit on risk, for example not taking on more than 5% of your account every day. Once you have reached your risk limit, stop trading and take some time to consider the situation.

7. Use Trailing Stops to Lock in Profits

A trailing stop adjusts its stop-loss as your trade progresses in your favor. This allows you to capture profits if the market reverses while giving your trade room to grow when it's in the direction of profit. This is a great method to make money while not close the trade.

8. Be aware of your emotions and avoid resentment Trade

Emotional trading could lead to poor decisions and excess risk. Fear, greed and frustration could cause you to take impulsive decisions or take on more risk than you planned. Avoid revenge trading following losing or trying to recover your losses all simultaneously. Keep losses from growing by sticking to your risk limit and strategy.

9. Avoid Trading During High-Impact News Events

Events that have a high impact on the news such as central bank decisions or economic news, can cause extreme market volatility. If you're not experienced with news trading it is better to exit positions or avoid trading in the days and hours following major announcements. This could result in unexpected losses.

10. Keep a Trading Journal To Review mistakes

Keep a diary to learn from your wins and losses. Record the details for each trade. The details must include the reason you traded, the degree of risk, the way in which the stop-loss was determined, as well as the result. The journal you keep will help you identify patterns in your failures and successes. This will help you enhance your risk-management skills over time.

Forex risk management for trading is equally important as identifying profit-making opportunities. These suggestions will help you to safeguard your capital and control losses. They can also assist in creating an effective trading plan that is long-lasting. Take a look at the top rated https://th.roboforex.com/ for site examples including forex and trading, forex trading app, forex trading forex, fx forex trading, forex and trading, fx trade, forex and trading, forexcom, forex best trading app, best currency brokers and more.

Top 10 Technical And Fundamental Analysis Tips When Trading Forex Online

Fundamental and technical analysis play crucial roles in Forex trading. Learning both of them can enhance your ability make strategic and well-informed choices. Here are the top 10 strategies to use fundamental and technical analysis to online Forex trading:Technical Analysis Tips

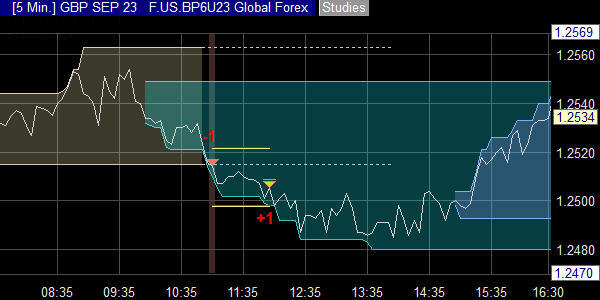

1. Determine the key levels of support and resistance

Support and resistance levels are price levels where currencies often stop or reverse. These levels are psychological barriers, which is why they are important when planning for the entry and exit. Make sure to identify these zones in order to understand where the price may reverse or fall.

2. Use multiple timeframes to gain a broader perspective

Different timeframes, such as the daily, four-hour, and one-hour charts are able to be used to understand longer-term and bigger trends. The higher timeframes reveal trends in general, while lower timeframes highlight specific entry points and timing.

3. Master Key Technical Indicators

Moving averages, Relative Strength Index and Moving Average Convergence Divergence are among the most significant indicators used in Forex trading. Learn about the purposes of each indicator and learn how to integrate them for improved accuracy.

4. Pay Attention to Candlestick Patterns

Candlestick patterns, such as dojis, hammers, or patterns of engulfings can indicate potential reversals. Be able to spot these patterns and to identify the possibility of price fluctuations. Combining candles with other tools such as support/resistance could aid in improving your timing.

5. Use Trend Analysis to find Directional Clues

Use moving averages and trendlines to determine uptrends and downtrends. Forex traders are frequently enticed to trade in the direction that the trend is going. This approach yields consistent outcomes. Avoid trading against the trend unless your knowledge level is very high.

Fundamental Analysis Tips

6. Understanding Central Bank Policy and Interest Rates

Central banks, including the Federal Reserve and the European Central Bank regulate interest rates that directly affect the value of currency. Higher interest rates tend to strengthen the currency. However, lower interest rates could weaken a currency. Keep an eye out for central bank statements, which can trigger market fluctuations.

7. Follow the Economic Indicators and Reports

The most important economic indicators like unemployment, GDP, inflation, or consumer confidence can provide valuable insights into the state of economic health of a nation and impact currency values. Keep up to date with the most recent economic announcements and analyze how they affect the currency pairs you have.

8. Examine Geopolitical Events and News

Elections or trade talks, as well as conflicts can impact on currency markets. Be aware of global news particularly about the major economies including the U.S.A, Eurozone, China. Be ready to modify your strategy if sudden geopolitical shifts occur.

Combining Fundamental and Technical Analysis

9. Align the Technical Signals with Fundamental Events

Combining technical and fundamental analysis can improve decision-making. If, for example, the technical setup indicates an upward trend and a positive economic report is expected, both of these factors could verify the validity of a buy signal. By aligning both strategies, you can reduce uncertainty and improves the likelihood of successful trading.

10. Utilize risky events to create trading opportunities

Price movements can be increased by news events that have a high impact, such as Federal Reserve meetings, or announcements of non-farm employment (NFP). Many traders steer clear of this time due to the unpredictability. However, if you are experienced, you can leverage the power of technical analysis to make the most of price fluctuations. Be cautious and set up tight stop-loss stops.

Forex traders benefit from an understanding of market movement by integrating technical and basic analysis. By mastering the techniques, traders are able to better navigate the market for currency and make smarter decisions as well as improve their performance and much more. Read the most popular https://th.roboforex.com/partner-program/ for blog advice including fbs broker review, forex market online, united states forex brokers, forex trading brokers, forex broker platform, fx trade, forex broker, app forex trading, foreign exchange trading platform, forex brokers usa and more.

Forex Trading Tips: 10 Financial And Personal Goals To Think About When You Are Considering Online Forex Trading

Forex trading requires that you set clear financial and individual goals. Well-defined trading goals keep you on track, focused and focused on your financial goals and helps you stay focused on your trading. These are the top 10 ways to manage and set financial and trading goals online.

1. Define Your Financial Objectives Clearly

Create certain goals for your financials such as a return on the investment or a monthly income. Determine if you want to focus on the growth of capital, income supplemental or conserving wealth. Clare goals help to align your strategy with the goals you're hoping to achieve.

2. Create a Realistic Timeframe

The process of learning, experimenting and increasing your knowledge of forex trading is a process that takes time. Establish short, medium and long-term goals to monitor your progress and avoid unreasonable expectations. You can establish a short-term strategy for trading and the long-term goal of return.

3. Determine Your Risk Tolerance

Assess your risk tolerance, and then align your goals with this. For instance, if you're hoping for high returns, be ready for higher volatility and potential losses. Knowing your risk level will allow you to choose strategies that don't exceed your comfort zone and assist you to define your goals.

4. Plan a Capital Allocation Strategy

Decide what percentage of your total finances you'll put into Forex trading. Make sure your trading capital is one you are able to afford losing without affecting your financial stability. This will ensure that you don't risk losing funds on expenses such as savings, bills or other personal obligations.

5. The focus should be on developing skills as a Primary Goal

Instead of focusing on financial gains make it a point to continually improve both your trading skills and also your knowledge. Skill development goals can include mastering specific trading strategies and improving your risk management, or gaining control of your emotions under pressure. With time, your skills get more consistent and refined.

6. Prioritize Consistency Over Large Wins

Many traders are looking to make huge gains quickly. However, experienced traders know that small steady gains last longer. Set realistic monthly gains as your aim. By focusing on consistent returns and avoiding high risk behaviors and establish a record of trustworthiness.

7. Be Consistent in Tracking and Reviewing Your Performance

Make it a point to keep a diary of trades where you can log every trade, review the outcomes, and consider lessons learned. You can alter the strategies you employ, fine-tune your method, and remain accountable by examining your results on a quarterly or monthly basis.

8. Set psychological and behavioral goals

Trading is a mental and mental discipline. Set psychological goals, like the reduction of impulsive trades, adhering to the plan for trading, and controlling your urge to retaliate against trades. These goals encourage a resilient and disciplined mind.

9. Comparing yourself to others is not a good idea

Forex trading is a private experience, and comparing yourself to the results of other traders could lead to unwise or risky choices. Your goals should be based on your own progress and financial capability, not the results of others. Concentrate on improving slowly rather than trying to be better than other traders.

10. Create an exit strategy and financial Milestone

You should think about setting goals so that you could either stop trading or take profits. Also, evaluate your performance. For instance, you can, withdraw some profits once you've reached a certain threshold, and enjoy them or reinvest in other areas. Having a "take-profit" measure can stop the risk of overtrading and allow you to appreciate your progress.

Establishing and implementing well-defined personal and financial goals for Forex trading can improve your discipline, ease stress, and guide you towards long-term success. You should alter your goals in the course of time, focusing on continuous improvement, consistency, accountability and personal accountability. Check out the best https://th.roboforex.com/forex-trading/platforms/metatrader5-mt5/ for more examples including fx forex trading, united states forex brokers, forex trading brokers, fx trading forex, fx online trading, fx trade, best forex trading platform, forex trading trading, forex trading platform, best forex trading app and more.